Why Interactive Brokers India

IBKR is the Professional's Gateway to the World's Markets

Global Market Access – Discover More Opportunities

Trade Indian stocks, options, futures and ETFs or access global markets and trade stocks, bonds and ETFs on 170 global markets from a single unified platform. Explore all available products worldwide.

View Global MarketsFund your account and trade assets in 29 currencies.1

Learn About Account FundingScan the world for investment opportunities with the World Map Screener and the World Data Screener.

Try IBKR GlobalAnalyst

Professional Pricing - Maximize Your Returns

IBKR offers low trading fees1 and access to stocks, options, futures, bonds and ETFs from a single unified platform. If an exchange provides a rebate, we pass some or all of the savings directly back to you.

Learn About Global Market CommissionsFor Indian Markets: Low commissions ranging from ₹6 to ₹20 per order.2 Zero account opening fees, no minimum activity fees and free DEMAT accounts.

Learn About NSE CommissionsEarn interest rates of up to USD 3.14% on instantly available cash.3

Compare Interest Rates- Low trading fees according to BrokerChooser Online Broker Survey 2026: Read the full article Online Broker Reviews, December 2025. "Interactive Brokers has low trading fees and one of the best margin rates in the industry. IB currently pays interest (up to 3.14% for USD) on cash balances if you have a $100k account (net asset value)."

NSE Commissions:

- NSE trades for Indian residents are calculated as 1 basis point, minimum INR 6 per order and maximum INR 20 per order with the below conditions.

- For stocks, up to INR 10 lakh order value per order, for the portion above INR 10 lakh, you will be charged 0.02% of the incremental value if placed in the same order.

- For futures and options, the above rate is limited to 100 lots in an order. For the portion of order above 100 lots, you will be charged INR 5 per lot if placed in the same order.

- The maximum per order for NRIs trading on the NSE will be INR 150.

- Additional external charges of Securities Transaction Tax, Exchange Charges, Statutory Tax and GST apply, click here for more information.

- NSE trades for Indian residents are calculated as 1 basis point, minimum INR 6 per order and maximum INR 20 per order with the below conditions.

- Restrictions apply. See additional information on interest rates. Credit interest rate as of January 7, 2026.

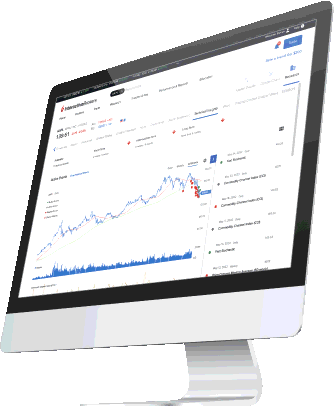

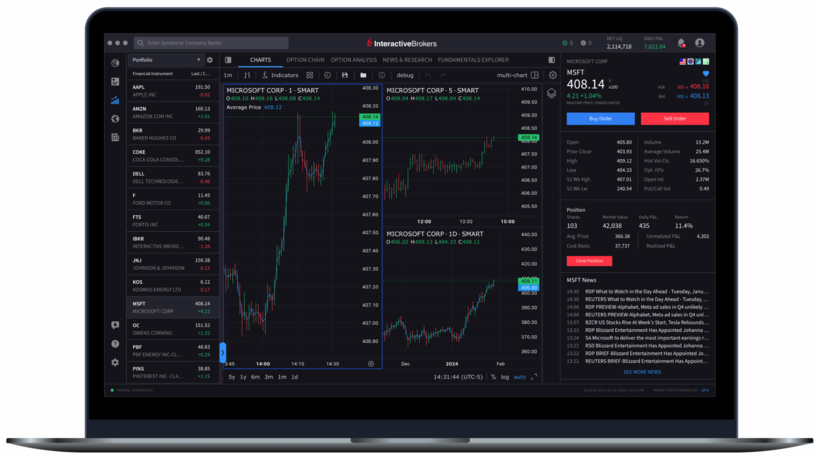

Powerful Trading Platforms To Help You Succeed

Award winning platforms for every investor from beginner to advanced on mobile, web and desktop.

Discover new investment opportunities with over 200 free and premium global research and news providers.

Spot market opportunities, analyze results, manage your account and make better decisions with our free trading tools.

100+ order types - from limit orders to complex algorithmic trading - help you execute any trading strategy.

Real-time trade confirmations, margin details, transaction cost analysis, sophisticated portfolio analysis and more.

The Best-Informed Investors Choose

Interactive Brokers

IBKR puts serious investors in control by combining low pricing, global market access, award-winning technology, and deep financial strength. With equity capital of $20.5 billion,1 and 170+ global market centers, IBKR truly serves investors who demand more.

A Broker You Can Trust

When placing your money with a broker, you need to make sure your broker is secure and can endure through good and bad times in the broader financial markets. Our strong capital position, conservative balance sheet and automated risk controls are designed to protect IBKR from major market events that can threaten the stability of financial institutions.

Member of the

S&P 500

Nasdaq Listed: IBKR

$20.5B

Equity Capital*

74%

Privately Held*

$13.3B

Excess Regulatory Capital*

4.40M

Client Accounts*

4.04M

Daily Avg Revenue Trades*

IBKR Protection

Interactive Brokers Group and its affiliates. For additional information view our Investor Relations - Earnings Release section.

TRADERS' ACADEMY

WEBINARS

TRADERS' INSIGHT

PODCASTS

QUANT BLOG

STUDENT TRADING LAB

On-Demand Educational Resources –

Never Stop Learning

Interactive Brokers provides several resources to help you better understand IBKR products and services, markets and technology.

Award Winning Platform & Services

#1 Professional Trading

#1 International Trading

Best Online Broker,

for Advanced Traders

Best for

Advanced Traders

Best Online Broker

Open Your Account Today!

Download an app and sign up, or sign up online

Disclosures

- Available currencies vary by Interactive Brokers affiliate.

- Low trading fees according to BrokerChooser Online Broker Survey 2026: Read the full article Online Broker Reviews, December 2025. "Interactive Brokers has low trading fees and one of the best margin rates in the industry. IB currently pays interest (up to 3.14% for USD) on cash balances if you have a $100k account (net asset value)."

NSE Commissions:

- NSE trades for Indian residents are calculated as 1 basis point, minimum INR 6 per order and maximum INR 20 per order with the below conditions.

- For stocks, up to INR 10 lakh order value per order, for the portion above INR 10 lakh, you will be charged 0.02% of the incremental value if placed in the same order.

- For futures and options, the above rate is limited to 100 lots in an order. For the portion of order above 100 lots, you will be charged INR 5 per lot if placed in the same order.

- The maximum per order for NRIs trading on the NSE will be INR 150.

- Additional external charges of Securities Transaction Tax, Exchange Charges, Statutory Tax and GST apply, click here for more information.

- NSE trades for Indian residents are calculated as 1 basis point, minimum INR 6 per order and maximum INR 20 per order with the below conditions.

- Restrictions apply. See additional information on interest rates. Credit interest rate as of January 7, 2026.

- Interactive Brokers Group and its affiliates. For additional information view our Investor Relations - Earnings Release section.